The Relative Strength Index (RSI) is a powerful momentum oscillator widely used in technical analysis to evaluate the speed and change of price movements in financial markets. Developed by J. Welles Wilder Jr. in the late 1970s, RSI has become an essential tool for traders seeking to identify overbought or oversold conditions in various asset classes, including stocks, commodities, and cryptocurrencies.

Definition of RSI

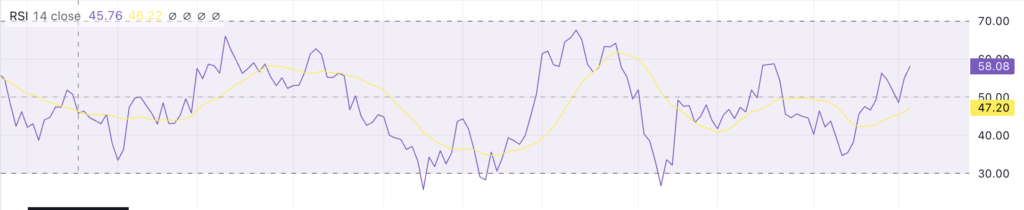

The RSI is a momentum oscillator that ranges from 0 to 100. It measures the velocity of price movements by comparing the magnitude of recent gains to recent losses. This comparison allows traders to gauge whether an asset is overbought or oversold, which can signal potential trend reversals or continuation patterns.

Purpose of RSI

The primary purpose of the RSI is to identify overbought and oversold conditions in a market.

- Overbought Conditions: An RSI reading above 70 typically indicates that an asset may be overbought, suggesting that its price has risen too quickly and may be due for a correction.

- Oversold Conditions: Conversely, an RSI reading below 30 signals that an asset may be oversold, indicating that its price has fallen too rapidly and might be poised for a rebound.

By identifying these conditions, traders can make more informed decisions about when to enter or exit trades. The RSI can also help spot potential trend reversals, allowing traders to capitalize on market movements.

Calculation of RSI

The formula for calculating the RSI is:

RSI=100−(1001+RS)RSI=100−(1+RS100)

Where:

- RS (Relative Strength) is defined as the average of X days’ up closes divided by the average of X days’ down closes. The standard period for calculation is typically set at 14 days.

To compute RS:

- Calculate the average gain over the specified period.

- Calculate the average loss over the same period.

- Divide the average gain by the average loss to obtain RS.

- Plug RS into the RSI formula to get the final value.

Most trading platforms automatically calculate the RSI, so traders do not need to perform these calculations manually.

Key Levels

The two critical levels for interpreting RSI readings are:

- 70: A reading above this level indicates overbought conditions.

- 30: A reading below this level indicates oversold conditions.

These thresholds serve as guidelines for traders to assess market sentiment and potential price reversals.

How RSI Works

The RSI operates on a scale from 0 to 100, with readings typically interpreted as follows:

- Above 70: Indicates that an asset may be overbought. Traders often look for selling opportunities or consider exiting long positions.

- Below 30: Suggests that an asset may be oversold. Traders may look for buying opportunities or consider exiting short positions.

In addition to these basic interpretations, the RSI can also confirm ongoing trends:

- Above 50: Indicates bullish momentum.

- Below 50: Indicates bearish momentum.

Historical Context

The concept of the Relative Strength Index was introduced by J. Welles Wilder Jr. in his book “New Concepts in Technical Trading Systems” published in 1978. Wilder aimed to create a tool that could provide insights into market momentum and help traders identify potential reversal points more effectively than existing indicators at that time.Since its introduction, RSI has gained widespread acceptance among traders and analysts across various financial markets due to its simplicity and effectiveness in identifying key market conditions.

Interpreting RSI Values

Interpreting RSI values involves understanding both absolute levels and divergences:

- Overbought (>70): When prices rise rapidly, leading to high RSI readings, it may indicate that a correction is imminent.

- Oversold (<30): Rapid price declines can lead to low RSI readings, suggesting a potential bounce back.

Divergence Signals

Divergence occurs when the price action of an asset moves in one direction while the RSI moves in another direction. There are two types of divergences:

- Bullish Divergence: Occurs when prices make lower lows while the RSI makes higher lows, indicating potential upward momentum.

- Bearish Divergence: Happens when prices make higher highs while the RSI makes lower highs, suggesting potential downward momentum.

These divergence signals can provide critical insights into potential trend reversals.

Limitations of RSI

While the RSI is a valuable tool, it does have limitations:

- False Signals: In trending markets, assets can remain overbought or oversold for extended periods without reversing.

- Lagging Indicator: The RSI is based on past price movements and may not always accurately predict future price action.

- Market Conditions: The effectiveness of the RSI can vary depending on market conditions; it works best in oscillating markets rather than trending ones.

- Subjectivity: Different traders may interpret RSI signals differently, leading to varying trading decisions.

- Over-reliance: Relying solely on the RSI without considering other indicators or market factors can lead to poor trading outcomes.

Adjusting RSI Settings

While the standard setting for calculating the RSI is 14 periods, traders often adjust this parameter based on their trading style and timeframe:

- Shorter Periods (e.g., 7): More sensitive to recent price changes; suitable for day trading.

- Longer Periods (e.g., 21): Smoother results; better suited for long-term analysis.

Traders should experiment with different settings to find what works best for their strategies and specific assets.

Combining RSI with Other Indicators

To enhance trading decisions, many traders combine the RSI with other technical indicators:

- Moving Averages: Using moving averages alongside the RSI can help confirm trends and entry/exit points.

- MACD (Moving Average Convergence Divergence): This indicator can provide additional confirmation when used with the RSI.

- Bollinger Bands: These can help identify volatility levels and potential breakouts when combined with RSI signals.

By integrating multiple indicators into their analysis, traders can improve their decision-making process and reduce reliance on any single indicator’s signals.

Examples of RSI in Action

Real-world examples illustrate how traders utilize the RSI effectively:

- Identifying Overbought Conditions:

- A trader notices that a stock’s RSI has crossed above 70 after a significant rally. Anticipating a pullback, they decide to sell their position or set a stop-loss order above recent highs.

- Spotting Oversold Conditions:

- After observing an asset’s decline with an RSI dropping below 30, a trader considers entering a long position based on expectations of a reversal or bounce back from support levels.

- Divergence Trading:

- A trader identifies bullish divergence where prices are making lower lows while the RSI shows higher lows. This signals them to enter a long position as they anticipate upward momentum building up.

Summary

The Relative Strength Index (RSI) is an essential tool for traders seeking to navigate financial markets effectively. By providing insights into overbought and oversold conditions and potential trend reversals, it helps inform trading decisions across various asset classes. However, understanding its limitations and combining it with other indicators enhances its effectiveness and reduces reliance on false signals.Incorporating proper risk management techniques alongside using the RSI will enable traders to make well-informed decisions while navigating complex market dynamics effectively.