The rise of cryptocurrency has sparked intense debates in financial circles, with some heralding it as the future of money while others remain skeptical. As digital currencies like Bitcoin and Ethereum gain mainstream attention, it’s worth exploring the future of cryptocurrency. Can it replace traditional money, or will it remain a niche financial tool? In this blog, we delve into an expert’s perspective to understand the potential and challenges of cryptocurrency as the future of money.

Daniel Foster is a seasoned financial guru known for his forward-thinking insights and ability to dissect complex market trends. Foster, with over 20 years of experience in traditional finance and a deep understanding of digital assets, has recently shared his thoughts on the future of cryptocurrency. Foster provides a balanced view on the rise of digital currencies like Bitcoin and Ethereum. He acknowledges the massive potential of cryptocurrencies to revolutionize global finance but cautions against the hype, urging investors to consider the challenges, including regulatory hurdles and volatility, carefully. According to Foster, while crypto might not fully replace traditional money soon, its role as a financial tool is undeniable, and those who understand its nuances stand to benefit greatly.

The Case for Cryptocurrency

Decentralization and Financial Sovereignty

One of the most compelling arguments for cryptocurrency as the future of money is its decentralized nature. Unlike traditional currencies, which are controlled by central banks and governments, cryptocurrencies operate on a decentralized network of computers. This decentralization offers users greater financial sovereignty, reducing reliance on traditional financial institutions. According to Foster, the decentralized nature of cryptocurrency could lead to a more inclusive financial system, particularly in regions where access to banking services is limited. Cryptocurrencies allow individuals to participate in the global economy without needing a traditional bank account.

Transparency and Security

Blockchain, the underlying technology behind cryptocurrencies, offers unparalleled transparency and security. Every transaction is recorded on a public ledger, making it nearly impossible to alter or forge. This transparency could reduce fraud and corruption, making cryptocurrencies an attractive alternative to fiat currencies. Daniel believes that blockchain technology’s security features could revolutionize the financial sector, particularly in cross-border payments and remittances, where fraud is a significant concern.

The Challenges of Cryptocurrency Adoption

Volatility and Market Speculation

Despite its potential, cryptocurrency faces significant challenges, particularly in terms of volatility. The value of cryptocurrencies can fluctuate wildly, often driven by market speculation rather than underlying economic factors. This volatility makes cryptocurrencies less stable as a store of value compared to traditional currencies. Foster argues that for cryptocurrencies to be considered a viable alternative to traditional money, they must achieve greater stability. This could come from increased market maturity, regulatory frameworks, or the development of stablecoins—cryptocurrencies pegged to stable assets like the US dollar.

Regulatory Hurdles

Cryptocurrency operates in a largely unregulated space, which poses both risks and opportunities. On one hand, the lack of regulation allows for innovation and growth; on the other hand, it creates uncertainty for investors and users. Governments around the world are grappling with how to regulate cryptocurrencies without stifling innovation. Foster suggest that a balanced regulatory approach is needed to ensure the growth and stability of the cryptocurrency market. Clear regulations could provide legitimacy and protection for investors, while also encouraging the development of the crypto ecosystem.

The Potential for Cryptocurrency Integration

Digital Payments and Global Transactions

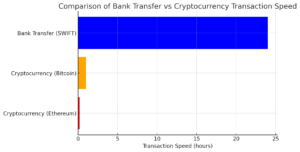

Cryptocurrencies offer significant advantages for digital payments and global transactions. They allow for near-instantaneous transfers of value across borders without the need for intermediaries, reducing costs and increasing efficiency. This makes cryptocurrencies particularly appealing in a globalized economy. Financial Foster see significant potential for cryptocurrencies in the realm of digital payments, especially for international transactions. As more businesses and consumers adopt digital currencies, we could see a shift towards a more decentralized global payment system.

For example, the chart highlights the stark contrast in transaction speed between traditional bank transfers via SWIFT and cryptocurrencies like Bitcoin and Ethereum. While bank transfers can take up to 24 hours or more to process, Bitcoin transactions typically take around 1 hour, and Ethereum can process transactions in as little as 12 minutes, showcasing the efficiency and speed of blockchain technology in financial transactions.

Smart Contracts and Decentralized Finance (DeFi)

Beyond currency, cryptocurrencies enable new financial models through smart contracts and decentralized finance (DeFi). Smart contracts are self-executing contracts with the terms of the agreement directly written into code. DeFi platforms use these contracts to offer services like lending, borrowing, and trading without the need for traditional banks.Foster highlight that the real innovation in cryptocurrency may not be as a currency replacement but as a catalyst for new financial systems. DeFi has the potential to democratize access to financial services, particularly in developing countries, and could reshape how we think about money and finance.

The Road Ahead: Cryptocurrency in the Financial Ecosystem

Coexistence with Traditional Currencies

Rather than completely replacing traditional money, many Daniel believe that cryptocurrencies will coexist with fiat currencies. Central banks are already exploring Central Bank Digital Currencies (CBDCs), which could integrate the benefits of cryptocurrency with the stability of government-backed currencies. The future of money might not be a zero-sum game between fiat and crypto. Instead, we could see a hybrid system where digital and traditional currencies complement each other, offering users more choices in how they store and transfer value.

Widespread Adoption and Mainstream Acceptance

For cryptocurrencies to become the future of money, they must achieve widespread adoption and mainstream acceptance. This means overcoming current challenges such as usability, regulatory concerns, and market volatility. Daniel suggests that as the technology matures and regulatory frameworks develop, cryptocurrencies could become a standard part of the financial landscape. However, this will require significant collaboration between the crypto community, regulators, and traditional financial institutions.

Conclusion

So, is cryptocurrency the future of money? The answer is complex. While cryptocurrencies offer exciting possibilities for financial innovation and decentralization, significant challenges remain. The future may lie in a hybrid model, where cryptocurrencies complement rather than replace traditional money. As technology evolves and the market matures, the role of cryptocurrency in our financial system will become clearer.

Curious about the future of cryptocurrency? Subscribe to our blog for the latest updates and expert insights on the evolving world of digital finance. What do you think—will cryptocurrency become the future of money? Share your thoughts in the comments below!