The upcoming U.S. presidential elections will ripple through the global financial landscape, potentially significantly impacting cryptocurrency markets. Investors and analysts closely watch the campaigns as America prepares for this important political event. They want to see how these campaigns could impact digital assets. This phenomenon is called by many “The Crypto Election 2024”

Cryptocurrency’s Meteoric Rise

The cryptocurrency market has experienced unprecedented growth in recent years, capturing the attention of both retail and institutional investors. The flagship cryptocurrency has reached new all-time highs, solidifying its position as a legitimate asset class. Even with some ups and downs, the crypto market is still on a positive path. Many investors see digital currencies as a way to protect themselves from traditional financial systems.

Historical Context: Elections and Crypto

Looking back at previous U.S. elections, the relationship between political outcomes and cryptocurrency performance has been complex. During the 2016 Trump-Clinton race, the crypto market showed minimal reaction, mainly because of its nascent stage.

However, the landscape has dramatically evolved since then. The previous 2020 election between Trump and Biden was a turning point. Cryptocurrency firms contributed about $119 million to influence federal elections. This significant increase in political engagement demonstrates the growing importance of regulatory considerations for the crypto industry.

Observations

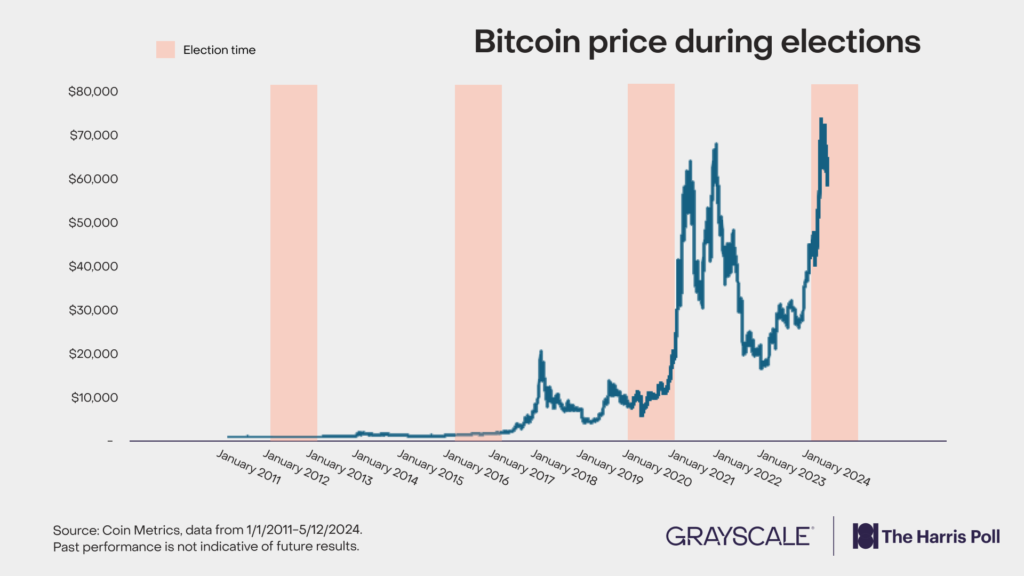

- Long-term Growth: Bitcoin’s price consistently grows throughout the period, regardless of election cycles.

- Pre-2016 Performance: Before the 2016 election, Bitcoin’s price was relatively low and stable compared to later years.

- Post-2016 Acceleration: After the 2016 election, Bitcoin’s price began to increase more rapidly.

- 2020 Election Impact: The period around the 2020 election coincides with a significant acceleration in Bitcoin’s price growth.

- 2024 Projection: The chart extends to the 2024 election, showing continued price growth, though this is speculative.

Trump’s Crypto Vision

Donald Trump’s recent embrace of cryptocurrency has caught the attention of many in the digital asset space. His appearance at a Bitcoin conference in Nashville changed his views. The former president said he wants to make the U.S. the “crypto capital of the planet.” Trump’s campaign has actively courted the crypto community, even accepting Bitcoin donations.

If he wins the election, This pro-crypto positioning could drive increased demand for digital assets. Some analysts predict that a Trump victory could push Bitcoin to new all-time highs by 2025.

Harris’s Crypto Conundrum

In contrast, Kamala Harris’s position on cryptocurrency remains less defined. As part of the current administration, Harris adopts a somewhat cautious approach to digital assets. However, there are indications that her stance may be evolving.

The “Crypto4Harris” virtual town hall held in August sparked interest in potential pro-crypto legislation. Additionally, prominent Democratic figures like Chuck Schumer have hinted at supportive crypto measures in the near future. Harris may face increasing pressure to clarify her position on digital currencies as the election draws closer.

Market Implications and Investor Strategies

The outcome of the U.S. presidential election could have far-reaching consequences for the cryptocurrency market. Investors are preparing for potential volatility and considering various scenarios:

- Regulatory Landscape: The winning candidate’s approach to crypto regulation will be crucial. A more favorable regulatory environment could attract institutional investors and drive adoption.

- Global Competitiveness: Trump’s emphasis on U.S. dominance in the crypto space could spur innovation and investment in blockchain technology.

- Economic Policies: Broader economic policies, such as inflation management and fiscal stimulus, could indirectly impact cryptocurrency valuations.

- Geopolitical Factors: The U.S. stance on crypto could influence global adoption and regulatory frameworks in other countries.

Preparing for “Crypto election 2024”

As the “Crypto election 2024” approaches, investors should consider the following strategies:

- Diversification: Spreading investments across various cryptocurrencies and traditional assets can help mitigate risk.

- Stay Informed: Keeping abreast of campaign developments and policy proposals is crucial for making informed investment decisions.

- Long-Term Perspective: There may be short-term fluctuations. However, concentrating on blockchain’s long-term potential can provide support during political uncertainties.

- Risk Management: Implementing stop-loss orders and maintaining proper position sizing can protect against sudden market movements.

The Global Ripple Effect

The U.S. election’s impact on cryptocurrency markets will likely extend beyond American borders. As the largest economy in the world, the U.S. leads in financial innovation. Its policies can greatly affect global crypto adoption and regulation.

Countries worldwide will watch closely and may change their own crypto strategies based on what happens. This could lead to a domino effect of policy changes and market reactions across various jurisdictions.

A Watershed Moment for Crypto

The U.S. presidential crypto election 2024 represents a critical juncture for the cryptocurrency industry. Digital assets are now a significant component of financial discussions. The next administration’s policies and attitudes will greatly influence this technology’s future. Investors must stay informed and flexible as they navigate this complex landscape.

The cryptocurrency market will likely stay dynamic and exciting regardless of the election outcome. It offers challenges and opportunities for those ready to engage with this new financial system.

The coming months will undoubtedly bring intense scrutiny and speculation to both the political and crypto spheres. The global financial community will watch closely as these two worlds merge more often. They are eager to see how this important situation develops.